Not ready to give up your spreadsheets or don't want to upgrade your existing software to an expensive monthly contract?

No problem!

Our bridging software can work with your existing way of doing things.

Any number of businesses can be added and easily selected (subject to licence purchased).

Whatever your VAT scheme, our solution is all you need to be MTD compliant with a direct upload to HMRC.

Listed on the HMRC site as software that has been tested.

If you want to sign up for MTD you can do so here.

The free 14 day trial uses simulated data for viewing HMRC data. You cannot submit a VAT return using the trial version.

Quick & easy to download and install with comprehensive documentation.

Visually stunning software that uses the very latest Windows technology!

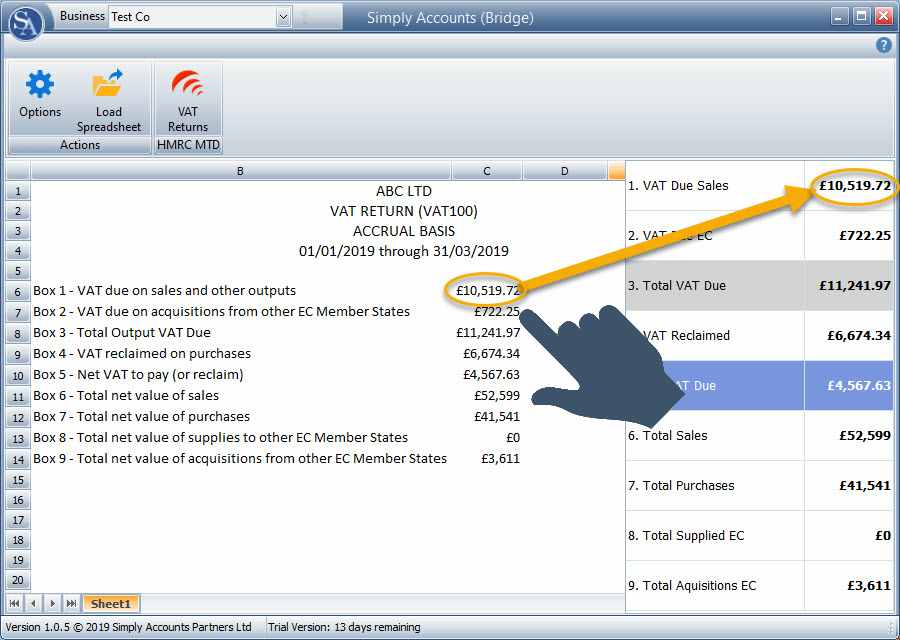

Simply drag the respective cells from your spreadsheet into the nine VAT boxes.

Submit your return directly to HMRC by clicking one button!

You're done!

Simply Accounts Bridge can also help users of existing accounting software that is not MTD compliant. Providing the software can produce/export information for a VAT return in a spreadsheet format, and in turn loaded into Simply Accounts Bridge, that business will become MTD compliant.

Not ready to give up your spreadsheets or don't want to upgrade your existing software to an expensive monthly contract?

No problem!

Our bridging web application can work with your existing way of doing things. It is both simple and easy to use.

Any number of businesses can be added and easily selected (subject to licence purchased).

Works in any browser on any platform including Apple Macs, tablets and mobiles.

Whatever your VAT scheme, our solution is all you need to be MTD compliant with a direct upload to HMRC.

Listed on the HMRC site as software that has been tested.

If you want to sign up for MTD you can do so here.

As well as submitting VAT returns you can view your obligations, liabilities & payments, and historical returns.

Our 14 day free trial allows you to fully test the software by being able to actually submit returns to HMRC!

No installation required.

Any browser can be used from any location using secure SSL encryption. Your VAT returns are not held on our server.

Simple method of allocating the cells in your own spreadsheet to the nine VAT boxes used for submission.

You are not forced into using an Excel template.

When you are ready, submit your return directly to HMRC by clicking one button!

You're done!

Simply Accounts Web Bridge can also help users of existing accounting software that is not MTD compliant. Providing the software can produce/export information for a VAT return in a spreadsheet format, and in turn loaded into Simply Accounts Web Bridge, that business will become MTD compliant.

You can sign up for a free 14 day trial of Simply Accounts Web Bridge here. The trial version is fully functional and allows you to submit VAT Returns but you must be signed up for MTD in order to do so!

Enables very quick and simple importing of full details from any online bank or credit card account including PayPal. Once these transactions are in the Cash Book the method of reconciliation is uncomplicated and straightforward. Includes a ‘bulk posting’ facility that will save hours and a ‘memory’ function for similar items.

Instant production of Annual Accounts, Profit & Loss and Balance Sheet

Cost Centre Reports & Trial Balance

VAT Return with EC Sales List

Invoices & Statements with Email facility

Prepare Invoices & Bills with

CIS Deductions

Support

We will continue to enhance Simply Accounts accounting software and provide automatic updates whilst your licence remains up-to-date.

The way Simply Accounts accounting software has been designed is that most functions are easy to understand and there is a comprehensive tutorial and help file.

We are on hand to help with any technical problems you may have and will ensure a remedy is found as quickly as possible.

Should you have any questions or suggestions please e-mail technical support with full details.

If you do have a problem you will immediately receive an auto-response which will confirm that we have received your question. Our reply to your question will be sent via email to the email address that was included in your registration details.

Please note our hours of business are Monday to Friday 8.30 am to 5.30 pm.

...found the support to be first class

I changed to Simply Accounts when it became clear that I needed to update from my previous package with the potential changes of MTD and Brexit looming. They offered a cost effective solution for me and I have found the support to be first class, with fast responses and a willingness to incorporate user requests into the product. As a non-accountant they have shown patience and courtesy as they have responded to my queries.

Before signing up I researched a lot of providers

I have found the software easy to use. Before signing up I researched a lot of providers and most would not have been suitable for my needs as they were far too complicated and / or expensive. I was very apprehensive about using it as I found the old system of online returns very convenient, but I needn't have worried. I would recommend it.

Would not want to be without it

I have been using Simply Accounts for nearly 8 years and I would not want to be without it. On the few occasions when I have needed support this has been very prompt and helpful.

For those businesses involved in the Construction Industry a separate Chart of Accounts may be selected. There is a facility to produce Invoices and enter Bills that have CIS deductions. Simply Accounts does not provide filing software.

From 1 March 2021 the domestic VAT reverse charge must be used for most supplies of building and construction services (CIS RC). The charge applies to standard and reduced-rate VAT services: for individuals or businesses who are registered for VAT in the UK reported within the Construction Industry Scheme. Please contact us if you need any further information.

March 2021

Our new Windows MTD bridging application is now available for those businesses that want to keep using their existing spreadsheets and still be MTD compliant.

It could not be simpler - drag and drop the relevant cells from your spreadsheet into the nine boxes of the application and click a couple of buttons! The application automatically displays all MTD VAT returns submitted, and those still open, as well as allowing you to display your account balance and retrieve full details of previously submitted returns.

Prices start at only £30 per annum for a single business.

March 2019

| All prices exclude VAT | Cloud Competitor | Simply Accounts |

|---|---|---|

| Annual Charge | £260 | £100 |

| With cost centres | £320 | £100 |

| Two businesses | £600 | £150 |

| Three businesses | £900 | £200 |

February 2019

Simply Accounts is now MTD ready and is listed on the HMRC website as MTD software for VAT that is available now. This involved coordinated testing between Simply Accounts and the HMRC MTD Team and, only after that can software be added to their site as being available.

As well as submitting your VAT return you can also retrieve VAT liabilities, payments and view previously submitted returns.

January 2019